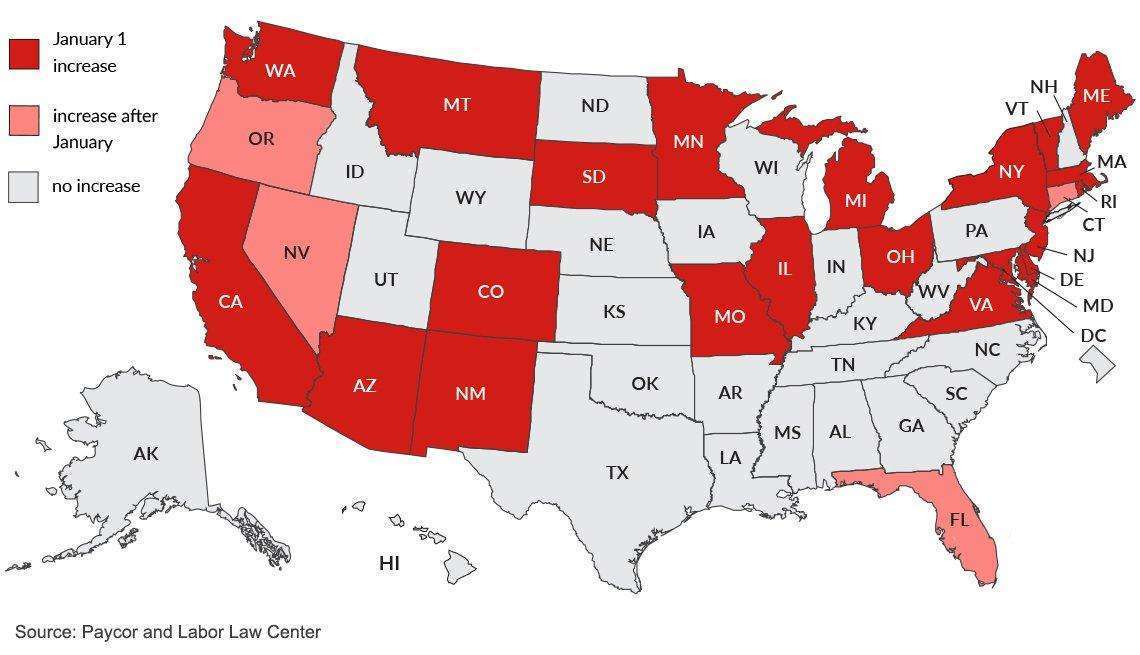

A wave of minimum wage raises has swept the country this year, with more than 20 states creating historic changes in labor laws. States that embraced the change guaranteed workers an increase anywhere between $.22 and $1.50 an hour. North Carolina, however, is among the many states that failed to participate in this change.

Those states, and the rates they will maintain, are as follows:

- $11: Arkansas

- $10.34: Alaska

- $10.10: Hawaii

- $9: Nebraska

- $8.75: West Virginia

- $7.25: North Carolina, Alabama, Georgia, Idaho, Indiana, Iowa, Kansas, Kentucky, Louisiana, Mississippi, New Hampshire, North Dakota, Oklahoma, Pennsylvania, South Carolina, Tennessee, Texas, Utah, Wisconsin and Wyoming

The federal government will also maintain their minimum rate at $7.25, as laid out in the Fair Labor Standards Act (FLSA).

What does this mean for employees?

Experts foresee a period of adjustment with these changes. Employers have a duty to update their payment practices and ensure they are providing the rate required in their states. However, even in states that did not make any changes, the FLSA and North Carolina-level legislation still guarantee your rights.

The Fair Labor Standards Act

Federal law stipulates employers who fail to pay minimum wage are liable for up to $1,000 per violation. Employees are eligible to receive the rest of what they are owed, referred to as back pay. The Wage and Hour division of the DOL can help individuals who believe they are owed more than they have gotten through the Workers owed Wages (WOW) tool. WOW is an enforcement arm for individual wage issues.

North Carolina Wage and Hour Act (NCWHA)

The NCWHA expands upon the FLSA to include additional requirements for employers such as timeliness of wage payments, vacation pay, withholding of wages, and record keeping requirements.

A prevailing employee represented by an attorney in an unpaid wages/salary lawsuit may be able to recover his reasonable attorneys’ fees, court costs, and interest. In NCWHA cases, the employee can even qualify for double back pay. Those payments are called “liquidated damages”, and are double the amount originally owed to compensate for any delays.

Thus, if an employer owes $15,000 in wages, a judge can award the employee $30,000, plus attorneys’ fees and costs.

Other Unpaid Wage Claims

Unpaid wage cases don’t exclusively surround issues of minimum pay. Recently, the US Department of Labor recovered more than $30,000 in back pay for employees of an Apex-based company contracted by the government. The DOL found Apex Plumbing and Heating, LLC, paid workers the prevailing rate for sheet metal workers, when in reality, they were performing the work of plumbers. The mis-classification meant employees were not paid the minimum required by law for their labor.

Misclassifying employees is just one of the many possible violations of state and federal labor laws. Other examples include unpaid:

- Vacation Time

- Bonuses

- Overtime

- Meal breaks

- Commissions

- Trainings

This of course is not an exhaustive list of FLSA/NCWHA violations. If you believe your employer owes you unpaid wages, please contact our office today.

Representation for Unpaid Wage Claims in North Carolina

Maginnis Howard’s employment attorneys represent employees unlawfully denied compensation from their employers. Our experienced attorneys can help you understand laws governing minimum wage, overtime wages, and other unpaid wages (vacation pay, bonuses, commissions, sick pay, and paid time off). To speak with an attorney, please call our office at (919) 526-0450 or submit an email request through our contact page.