I’ve been reading some books on screenwriting. I’m not having a midlife crisis (yet), but what better way to learn how to better communicate the story of your case to a jury then to learn how to tell a story like a pro?

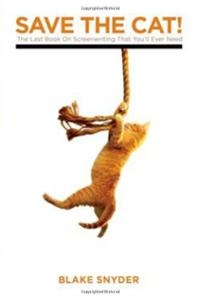

There’s a famous screenwriting novel called “Save The Cat” by Blake Snyder. In case you were wondering where the title comes from, there’s a scene early on in movies where the hero (or soon to be hero) does something smaller that makes you immediately like them and want to root for them. Sure, this guy may seem like a jerk right now, but when he saw that cat up in the tree, HE SAVED IT.

Snyder writes that there are a few basic categories of movie scripts that work for audiences and gives them all memorable names. For example, there’s a “Dude With a Problem” movie, where an ordinary person find themself in extraordinary circumstances. This Dude uses his own individual traits — the things that make him him — to save the day from the far more powerful bad guy. Or a “Golden Fleece” movie, where the hero goes on the road ready to do something but ends up discovering something far more important … himself. Any of these sound familiar?

There’s also “Monster in the House,” where there is a confined space, there is a sin committed (usually greed), which prompts the creation of a hero who enters the scene to destroy the bad guys. Think Panic Room or Jurassic Park. Snyder writes that there HAS to be a confined space for this to work. If you aren’t trapped in this space, the audience thinks… uh just leave the area asap and now you don’t have to deal with this scary monster!

This one got me thinking. Our firm has had a lot of cases against mortgage servicers lately. Where the servicers of your mortgage loan are charging you unnecessary fees, calling you on your cell phone constantly to collect debt, sending threats to foreclose, and sometimes wanting money when your deed of trust says you don’t owe them a dime. You feel helpless and feel like there’s nothing you can do about it.

But here’s the thing, you can’t escape mortgage servicers unless you are able to pay off the entirety of your loan right then and there. And the vast majority of the time, you didn’t sign up to do business with these guys. You made an informed decision after lots of research who you wanted to do your home loan with, and then it was immediately sold, securitized into a portfolio, and the rights to your loan were shipped off to whoever your lender wanted to sell them to. You have absolutely no control over who you do business with, and there’s no escape. Sound familiar?

If you are having problems with your mortgage servicer, a judge and jury are the heroes who can destroy these bad guys. There are state and federal laws which require mortgage servicers to play by the rules when dealing with their customers. If you are in North Carolina, our firm offers free consultations to discuss whether we might be able to help you. Contact the firm at (919) 526-0450 or send a message through our confidential contact page.